La Nostra Compagnia

Chi siamo

Generali Country Italia è leader nel mercato assicurativo italiano retail e tra gli assicuratori più importanti al mondo. La compagnia nasce il 1 luglio 2013 quando viene conferito il ramo italiano delle Assicurazioni Generali in INA Assitalia e viene cambiata la denominazione in Generali Italia SpA. In un secondo momento sono poi state integrate le attività assicurative del Gruppo Toro (Toro, Lloyd Italico e Augusta). Dal 2015 presenti in Italia con un unico brand.

Il nostro purpose è «consentire alle persone di creare un futuro più sicuro e più sostenibile prendendoci cura delle loro vite e dei loro sogni». Agiamo con il nostro business, le nostre persone e l’impegno nella società per contribuire al benessere economico, sociale e ambientale (ESG) del Paese, generando un impatto concreto e positivo.

| 11 milioni di clienti | 28 miliardi di premi al 2022 |

| 15 mila dipendenti | 40 mila distributori |

| 1 su 3 famiglie ha una polizza | 1 su 4 imprese è assicurata con noi |

Con 11 milioni di clienti, siamo il primo assicuratore in Italia. Consapevoli di questa responsabilità, assumiamo il ruolo di guida per governare il cambiamento e contribuire a una crescita di valore per i nostri dipendenti, clienti, agenti e complessivamente di tutti gli stakeholder della Compagnia e del sistema Paese.

Le nostre soluzioni assicurative

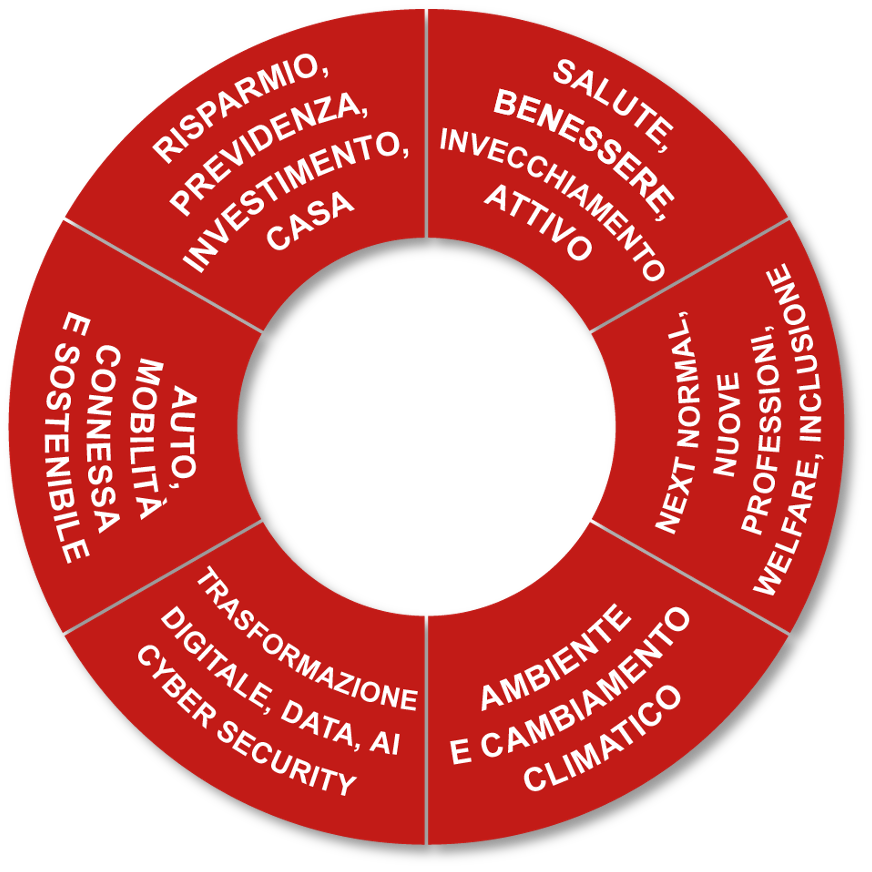

Per noi Partner di Vita significa essere al fianco delle persone in tutti i momenti rilevanti, offrendo la miglior customer experience attraverso tutti i canali di relazione, prevenzione e protezione con più servizi e tecnologia.

Vogliamo perseguire una crescita profittevole, con il focus sulla protezione, garantire una sempre migliore customer experience e accelerare l’efficienza del modello operativo.

Generali Country Italia

Oltre a Generali Italia, oggi nel nostro Paese il Gruppo comprende altre tre compagnie assicurative: Alleanza Assicurazioni, organizzate con una propria rete di consulenti, Genertel e Genertel Life, Compagnie diretta vita e danni, DAS Compagnia specializzata nella difesa legale. A seguito della fusione per incorporazione di Cattolica Assicurazioni, dal 1 luglio 2023 Generali Italia ha costituito la Business Unit Cattolica, che ha mantenuto lo storico brand di Cattolica Assicurazioni e una propria rete di distribuzione commerciale.

Oltre alle compagnie sopra citate, due società di servizi, Generali Welion – società di welfare integrato che offre alle famiglie, alle imprese e ai lavoratori servizi innovativi e semplici da fruire nell’ambito della sanità, della previdenza, dei flexible benefits e della non autosufficienza – e Generali jeniot – società dedicata allo sviluppo di servizi innovativi, nell’ambito dell’Internet of Things e della Connected Insurance, legati alla mobilità urbana, alla casa intelligente, alla salute e al mondo del lavoro connesso.

Inoltre Leone Alato, la più estesa azienda agroalimentare italiana, e tra le principali in Europa che ha al suo interno Le Tenute del Leone Alato, la divisione vitivinicola del Gruppo e Genagricola 1851 che coltiva ed amministra oltre 14.000 ettari di superficie agricola in Italia e Romania.

Cattolica Assicurazioni

Cattolica Assicurazioni, fondata a Verona nel 1896 (qui la storia) compagnia del Gruppo Generali in seguito alla conclusione dell’Offerta pubblica nel 2021.

Ispirata alla Dottrina Sociale della Chiesa e a un patrimonio di valori che derivano direttamente dalla sua origine, Cattolica privilegia la tutela assicurativa delle persone, delle famiglie e delle realtà produttive, con una attenzione particolare al territorio ed ai contesti sociali ed economici in cui esse operano. I suoi tratti distintivi sono la presenza e radicamento su tutto il territorio italiano, grazie a una rete di agenti capillarmente diffusa. Vanta una forte specializzazione nei comparti dell’agroalimentare, imprenditoriale e professionale, e del mondo religioso e associativo, con particolare attenzione al Terzo Settore.